Cloud Integration and Custom Software Solutions: A Winning Combination for Fintech

From personalized recommendations powered by AI to seamless mobile shopping experiences and real-time inventory management, Custom Retail Software Solutions are revolutionizing the retail industry. These tools aren't just tools anymore—they're strategic assets that enable retailers to understand, predict, and respond to customer needs with unprecedented precision.

The fintech industry has traveled a long way from complicated and traditional jargon, such as managing paperwork and checking bank account details with outdated legacy systems.

Today it has arrived at the new and innovative digital transformation station by coupling with next-generation technologies like artificial intelligence, machine learning, blockchain, and of course cloud services.

Cloud integration Fintech has empowered banks and financial institutions to deliver top-notch services and scale upwards based on evolving customer demands. This takes us to further discussion on how cloud services along with custom software solutions are writing the success stories of fintech enterprises.

Why Cloud Services Are Necessary For the Fintech Sector?

Before we proceed further with this blog, let’s just throw some substantial light on why cloud services have become more than a necessity for the fintech industry.

- First and foremost, it allows the fintech companies to upscale their processes based on customer requirements and demands. The increased scalability helps financial institutions efficiently manage large volumes of transactions (online and offline) and other user activities without any hindrances.

- Cloud services enable fintech companies to minimize their capital expenditures, especially those related to maintaining physical IT infrastructure and servers. Cloud services, such as SaaS, PaaS, and IaaS help in significant cost savings.

- Faster development of software applications is another viable reason cloud services are necessary for the fintech industry. They can assist companies in launching new products, features, and updates quickly and stay ahead of the competition.

- Today banks and financial institutions prioritize robust security and regulatory compliance more than ever to protect sensitive customer information and data. Cloud solutions provide assurance and compliance with regulatory requirements.

- Ultimately financial companies can harness the latest trends and technologies in the Fintech industry to improve customer experience, innovate solutions, and gain real-time data insights. They can create new products and services for their customers.

The Custom Software Development Company Enables the Fintech Industry to Unleash Cloud Services Benefits

So, you are now familiar with the core benefits of cloud services in the Fintech business. But how will you leverage these advantages?

You need to partner with a custom software development company having expertise in cloud integration Fintech to unlock the full potential of cloud services.

These companies provide an extensive range of services, including custom software development, cloud integration and migration, robust security, and continuous support. This helps the fintech industry lower operating costs, upscale innovation, and follow regulatory compliance.

Let us highlight the role of bespoke software development in the Fintech below.

- Tailored Software Solutions- The custom software for fintech allows financial institutions to meet their unique needs, enhancing efficiency and customer satisfaction.

- Implementing Advanced Technologies - Custom software developers and engineers assist in implementing advanced technologies, such as artificial intelligence, machine learning, and IoT, ensuring the Fintech industry leverages the most of cloud services.

- Enhanced Scalability and Robust Security - Choosing custom software development services lets the fintech companies scale their operations seamlessly and maintain peak performance during increased traffic. They also incorporate high-end security practices like data encryption and user authentication to secure sensitive financial data.

- Cost Reduction and Optimization - Custom software development services help Fintech businesses reduce operational costs and improve optimization through pattern usage analysis.

- Smooth Integration - Cloud integration Fintech becomes seamless with custom software development as the Fintech businesses can integrate various third-party services and apps ensuring interoperability and simplified transition.

- Complete Support and Maintenance - Custom software development for Fintech allows developers to provide continuous ongoing support and maintenance services, ensuring that the system runs smoothly without downtime issues and provides quick resolutions.

- Roll Out More Innovative Products - Fintech companies can roll out more innovative and updated products quickly and easily based on customer demands to gain a competitive advantage.

- Compliance and Risk Management - Financial Software Development Solutions ensure that the Fintech companies are complying with the latest industry standards and set regulations, mitigating cloud deployment risks.

Leverage Cloud Services and Custom Software Solutions to Revolutionize Fintech Operations

Innovate Financial Services By Implementing Advanced Technologies

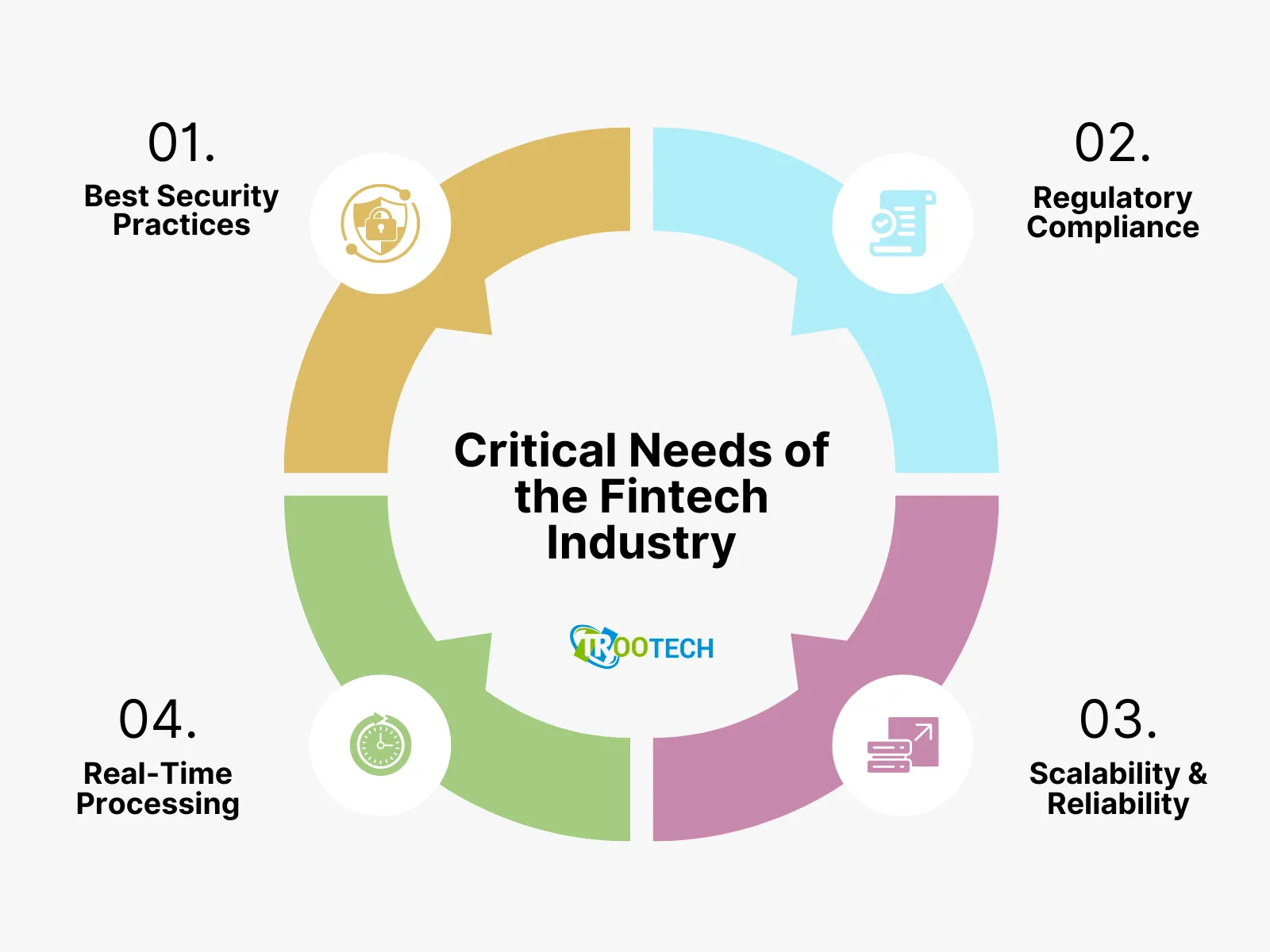

Understanding the Critical Needs of the Fintech Industry - Security Compliance and Scalability

Implementing the Best Fintech Security Practices

The Fintech industry has undergone a sea change with online banking and mobile transactions gaining more traction. This calls for more security-fortified applications and software solutions where unauthorized access and data breaches are next to impossible.

At a time when the value of total digital transactions has exceeded close to $12 billion, implementing best security practices sucha as robust and reliable security code, integrating code obfuscation, data encryption, multi-factor authentication and user roles and access become paramount to fortified data.

Achieving Regulatory Compliance for the Fintech Industry

The financial sector has to pay attention in multiple directions to secure sensitive data. It not like following the latest security practices. Yes, complying with all regulatory requirements and laws is mandatory for all fintech businesses.

The necessary regulatory compliance that all financial institutions have to compulsorily adhere to includes the Financial Industry Regulatory Authority (FIRA), Security and Exchange Commission (SEC), and General Data Protection Regulation (GDPR), among others.

The regulatory compliance requirements focus on four key areas; anti-money laundering regulations, data privacy regulations, KYC regulations, and implementation of cybersecurity standards.

Enhancing Scalability for Fintech Companies

Cloud services allow Fintech companies to adjust their resources based on demand to scale efficiently and rapidly. They can also adopt microservices architecture to upscale individual components to enhance system reliability, simplify updates, and improve overall performance.

Fintech companies can also incorporate auto-scaling policies that allow them to automatically increase server instances based on real-time traffic. By leveraging scalable technologies, fintech companies can adapt to market demands swiftly and sustain long-term growth.

The Need For Real-Time Processing in Fintech Enterprises

Real-time processing allows Fintech companies to provide instant services to their customers. This includes immediate online transactions, instant fraud detection, and real-time data analysis. However, to achieve this, the Fintech firms must ensure high-speed data processing and management and low latency communication.

The main aim of real-time data processing for Fintech is to enhance customer experience and satisfaction, including improved risk management, and identification of suspicious financial transactions.

Financial companies can access updated information data to make informed decisions and personalize services for customers. It also minimizes delays and inefficiencies.

Key Fintech Challenges to Managing IT Infrastructure

According to the latest State of Cloud Report, almost 70% of organizations state that more than half of their IT infrastructure is in the cloud. Despite this significant shift, many fail to leverage the full potential of cloud services to boost their business processes.

As fintech businesses grow, upscaling cloud infrastructure becomes essential. However, managing IT infrastructure in the fintech sector presents several challenges. These challenges include:

The Challenge of Data Security and Regulatory Compliance

Fintech businesses predominantly handle highly sensitive data, making data security and regulatory compliance critical. Ensuring proper data storage and controlled access is a significant challenge for many financial institutions. They must adhere to specific regulations in the countries where they operate, which can complicate global expansion plans.

Disaster Recovery and Data Backup Failures

A common issue that can disrupt cloud service scaling and IT infrastructure management is the lack of a comprehensive disaster recovery and data backup plan. Financial enterprises must engage fintech developers with expertise in regular data backups and protecting confidential data from breaches and unauthorized access.

Unable to Handle Peak Loads

Managing peak loads without compromising application performance and data security is a recurring issue in the fintech industry. Ensuring high performance and availability with low latency during peak demand is a critical challenge that requires effective cloud scaling strategies.

Architectural Complexity

Fintech companies often struggle with seamless and secure data transfer and smooth communication between different cloud platforms. This is mainly due to improper data integration and inconsistencies, which can delay business processes and affect overall efficiency.

Lack of Proper Expertise

One of the major causes of cloud data breaches is the lack of proper training and expertise in cloud developers, leading to costly human errors. It can also hinder performance and increase the risk of malfunction. The best solution is to hire experienced cloud professionals and engineers who can scale up cloud infrastructure.

Choose Our Cloud Services to Ensure High-End Scalability and Robust Security

Get Seamless Cloud Integration To Enhance Fintech Operations

Cloud Service Providers For Fintech: The Key Players

Gartner’s Fintech Report states that 85% of financial companies will adopt a cloud-first approach by 2025. This underlines why cloud services are more than a necessary asset for the Fintech sector.

When you search for top cloud service providers, you will find multiple options, such as Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform, Alibaba Cloud, IBM Cloud, and Oracle Cloud Infrastructure (OCI).

However, here, we are going to discuss popular three cloud service providers:

Amazon Web Services (AWS)

The first on this list is AWS or Amazon Web Services, which holds the edge over its competitors in cloud service market share with 31%, according to Statista's latest report. Let’s explore what AWS services for Fintech are.

AWS services for Fintech is a cloud computing platform powered by Amazon Web Services, digitally transforming the financial industry using cutting-edge technologies and custom software solutions. It allows financial institutions to increase their agility, security, and scalability.

These advanced technologies, including artificial intelligence, machine learning, data analytics, and blockchain, help minimize operational costs and significantly enhance customer experiences.

AWS services for Fintech can seamlessly manage large datasets efficiently and securely, making it an ideal choice for banks, trading platforms, insurance companies, and more. Furthermore, it aligns with important fintech regulatory and compliance requirements like GDPR and CCPA.

Top Features of AWS Services in Fintech

- AWS Lambda: Allows fintech software development companies to create serverless applications and streamline code execution for accurate billing based on milliseconds, seconds, or minutes, minimizing development costs. AWS Lambda is best suited for microservices and event-driven architectures and focuses on code-level security.

- AWS Fargate: Enables fintech firms to run containerized applications without managing servers. It offers scalability, security, and cost-efficiency, ideal for handling variable workloads and ensuring high availability.

- AWS Shield: A managed Distributed Denial of Service (DDoS) protection service that safeguards fintech applications running on AWS. It provides automatic detection and mitigation of DDoS attacks, ensuring high availability and minimal downtime.

- AWS KMS: Key Management Service helps developers build and manage encryption keys, passwords, and user identities to bolster financial data security. It is compliant with GDPR, HIPAA, DSS, and PCI.

Core Benefits of AWS Services in Fintech

- Cost-Efficiency - AWS offers cost-efficiency and optimization with a pay-as-you-go model, facilitating users to only pay for the cloud resources they use.

- Higher Scalability - AWS services for Fintech provide top-notch scalability and flexibility, allowing financial companies to scale up their infrastructure and operations seamlessly based on demand.

- Speed and Agility - Financial institutions and trading applications can quickly launch new features and upgrade the existing ones, allowing them to improve their market responsiveness. The agility enables them to make more innovative solutions.

- Data Management and Analytics - Using data management and analytics tools, financial companies can extract real-time data insights to drive better decision-making and risk assessment.

- Security and Compliance - AWS provides unparalleled security with robust data encryption, identity management, and user access control, following all security standards and compliance protocols.

Microsoft Azure

Microsoft Azure for Fintech manages the financial data at scale and allows banks and financial institutions to offer streamlined services and deliver exceptional customer experience. This cloud computing for the Fintech industry also curbs financial crimes by enhancing security, regulatory compliance, and interoperability.

The market share of Microsoft Azure Cloud is 25% just below AWS. Like AWS. MS Azure uses AI and ML algorithms to drive real-time insights for enhanced and informed decision-making. It also gets ample support from other Microsoft solutions like Microsoft 365, Microsoft Dynamics 365, and MS Power BI Platform to automate and optimize financial operations.

Key Microsoft Azure Services for Fintech

- Azure Blockchain Service: Allows financial companies to create and deploy blockchain networks with complete transparency, security, and traceability.

- Azure Security Center: A comprehensive security management system with advanced threat protection features and protocols to secure sensitive financial data from cyberattacks.

- Azure Machine Learning: A unified machine learning solution that helps create, train, and deploy models, enhancing decision-making with predictive analytics and data-driven insights.

- Azure SQL Database: A powerful and robust managed relational database powered by artificial intelligence to optimize financial performance. It offers high-end scalability and strong security to protect financial data.

Core Benefits of Microsoft Azure For Fintech

- Scalability and Flexibility - MS Azure allows financial companies to upscale their operations and efficiently handle increased volumes of transactions during peak times. They can expand services quickly to meet customer demands.

- Security and Compliance - Microsoft has invested heavily in security to offer fortified and robust security solutions, such as threat detection, data encryption, and identity management.

- AI and ML - AI and ML solutions allow financial institutions to create and deploy intelligent applications and automate repetitive tasks.

- Cost-Efficiency - Like AWS, Azure also offers a pay-as-you-go model where the user only has to pay for the service or resource they use.

- Data Analytics and Insights - Using Azure’s advanced data analytics and insights, financial companies can gain deeper insights into customer behavior, market trends, and preferences.

Google Cloud Platform

Google Cloud Platform helps innovate financial services with omnichannel customer experiences and transforming data analytics for intelligent decision-making and improving operational efficiency. It offers tailored services for Fintech software development to build scalable, flexible, agile, and secure platforms based on evolving customer demands.

Key GCP Services for Fintech

- BigQuery - It is a serverless data warehouse and fully managed GCP service that accelerates the SQL queries by implementing Google infrastructure processing power.

- Google Cloud Armor - As the name suggests, this GCP service offers robust and reliable security using DDoS protection and advanced threat detection systems to protect highly confidential data.

- Apigee API Management - Cloud developers and engineers use Apigee to create, secure, and manage APIs and API platforms, improving connectivity and integration.

- Google Kubernetes Engine (GKE) - Google Kubernetes Engine (GKE) is a managed Kubernetes service that simplifies deploying, managing, and scaling containerized Fintech applications. GKE enhances reliability, security, and scalability, enabling rapid innovation and compliance with regulatory standards.

Core Benefits of GCP For Fintech

- Scalability and Flexibility: GCP’s scalable infrastructure supports rapid growth and dynamic workloads so that fintech applications can handle peak demands without compromising performance.

- Security and Compliance: GCP for Fintech is enabled with advanced security features, such as encryption at rest and in transit, Identity and Access Management (IAM), and compliance with industry standards like PCI DSS, ensuring robust protection of sensitive financial data.

- Innovation and Speed to Market - With tools for AI, machine learning, and container orchestration, GCP accelerates the development and deployment of innovative financial solutions.

Select the Best Cloud Service Provider That Aligns With Project Requirements

Take the Next Step Towards Embracing Cloud Engineering Services

Custom Software Solutions is the Gateway to Tailored Cloud Services For Fintech

Now, that we have discussed in length the role of leading cloud service providers to innovate and streamline the Fintech industry, let’s see how custom software development can tailor cloud services to meet specific Fintech needs.

Custom APIs Allow Seamless Integration With Cloud Services

Fintech companies rely heavily on data and custom APIs allow them to seamlessly integrate tailored third-party apps and solutions with cloud services. This paves the way for smooth data exchange and efficient communication using the advanced interface to access cloud resources. It ensures interoperability and flexibility and automates workflows across platforms.

Enhancing Data Security With Advanced Solutions

Security is paramount for the Fintech industry, and this is where custom authentication, identity management, advanced user controls, and custom encryption come into play. These solutions help to encrypt sensitive data based on organizational needs and regulatory compliance by region, enhancing data privacy and integrity against unauthorized access.

Compliance Tools Automates Reporting and Monitoring Capabilities

Hire software developers to build tools that automate compliance reporting and monitoring of financial data with real-time tracking of compliance status to identify potential issues. The custom software for Fintech helps to minimize manual processes and update reports based on the latest industry trends, offering actionable insights and mitigating risks.

Enhanced Scalability to Handle Peak Loads

Enhanced scalability is one of the core benefits of cloud services and custom cloud solutions that allows Fintech enterprises to scale and make their operations more agile. They can scale their customized solutions up or down based on the requirements, which helps them to quickly adapt to the changing market conditions and handle high volumes of transactions at peak hours.

Case Studies and Success Stories

In this section, we narrate the success stories of how AWS, Azure, and GCP cloud service providers have enhanced the prospects of various Fintech companies—a startup, a mid-sized enterprise, and an established financial institution.

AWS Helps A Fintech Startup to Scale its Operations Using AWS and Microservices Architecture

A Fintech startup encountered difficulties in scaling its operations due to increased customer demands. By harnessing AWS cloud services and implementing a microservices architecture, the startup increased its application scalability smoothly and rapidly. The core AWS services used to achieve this goal were AWS Lambda and AWS Fargate, which integrated serverless computing and efficient container management with custom APIs. This approach allowed the startup to increase scalability and flexibility, resulting in an improved user experience.

Azure Improves Data Security and Compliance For a Mid-Level Financial Firm Using Custom Monitoring Tools

A mid-level financial company faced significant data security and compliance issues. To overcome these challenges, the company invested in Microsoft Azure cloud computing solutions to create smart and efficient customized monitoring tools. The advanced system fortified security and compliance with regulatory requirements. Microsoft Azure Security Center Services provided the necessary threat protection, while the firm used compliance software to automate reporting and monitoring processes. The outcome was enhanced data security, minimized compliance risks, and improved operational efficiency.

GCP Optimizes Data Analytics and Reporting for an Established Fintech Firm Using BI Tools

An established banking institution leveraged the Google Cloud Platform and tailored business intelligence solutions to optimize its data analysis and reporting capabilities. By accessing real-time actionable insights and enhancing decision-making, the institution saw significant improvements. The core service used was BigQuery, which enabled efficient data querying, while the BI platform offered comprehensive and intuitive data visualization and reporting. This allowed the financial firm to make better-informed decisions and gain real-time customer insights, thereby enhancing business performance.

Our Approach to Empowering Fintech with Cloud Services

At TRooTech, we adopt a comprehensive and strategic approach to empower Fintech companies using cloud services. Our expert consultant and development team focus on three prime areas.

Complete Consultation and Analysis of the Project Requirements

We begin our task by conducting a thorough consultation with the client to understand their project requirements and scope. Thereafter, our consultant and development team sit together to discuss the project feasibility and critically analyze the pain points the fintech business is experiencing.

Our job is not done yet. We help our clients by suggesting the best tools and technologies required to mitigate their issues and choose the appropriate cloud service provider based on project needs.

Custom Development and Integration Services

Our next task is to create a comprehensive strategy for selecting the best custom software solutions to accelerate and streamline the development process. Our developers craft bespoke software applications with zero errors and implement the latest technologies that seamlessly integrate with cloud services.

TRooTech also provides an end-to-end cloud migration strategy to upgrade your software to the latest version. Additionally, if you wish to switch cloud service providers, such as transitioning from Azure to AWS, we can assist you with that as well.

Ongoing Support and Optimization

At TRooTech, we don’t just stop at high-quality development, testing, and deployment. We also provide continuous ongoing support for maintenance and issue resolution post-implementation. Our support and optimization services are designed to ensure your software evolves with your business needs and customer requirements.

We focus on enhancing your cloud services with increased scalability, robust security, and performance upgrades, enabling you to handle increased traffic during peak hours seamlessly.

Conclusion

The duo of cloud services and custom software solutions has taken the Fintech industry to the next level where financial companies leverage enhanced scalability, improved flexibility, high-end and uncompromising security, and provide exceptional customer experiences.

It has allowed financial institutions to detect fraud more accurately and quickly and comply with regulatory standards, such as GDPR, PCI, and DSS. Custom software development companies are helping Fintech firms choose their cloud service provider (AWS, Azure, or GCP) to unleash the benefits of cloud services and tailored software solutions.

At the same time, Allied Market Research has predicted that the Fintech cloud market size is expected to reach approximately up to $196.2 billion by 2031. This means that cloud services will have a huge impact on the Fintech sector.

So, this is the right time for financial companies to move to the cloud and transform their overall operations. If you are planning to migrate to cloud services, do contact our team to help you out with a comprehensive tailored strategy!

FAQs

Cloud integration in Fintech involves connecting financial systems, applications, and data to cloud platforms, enabling seamless data exchange, real-time processing, and enhanced interoperability. This integration facilitates streamlined operations, improved efficiency, and better scalability, allowing fintech companies to offer innovative financial services and adapt quickly to market changes.

The fintech industry leverages cloud services for scalable infrastructure, advanced data analytics, fraud detection, secure data storage, and enhanced customer relationship management. Cloud services enable fintech companies to innovate rapidly, reduce costs, improve operational efficiency, and maintain compliance with regulatory standards while delivering superior customer experiences.

Custom software solutions provide Fintech firms with tailored functionalities, enhanced security measures, and better compliance with financial regulations. These solutions ensure seamless integration with existing systems, improve user experience and offer greater flexibility to adapt to evolving business needs and technological advancements, fostering innovation and competitive advantage.

The core challenges of cloud services integration in Fintech include ensuring robust data security, meeting stringent regulatory compliance requirements, managing seamless data migration, and minimizing operational disruptions. Additionally, integrating legacy systems with modern cloud infrastructure can be complex, requiring careful planning and execution to maintain service continuity and data integrity.

Among the various companies offering cloud services for Fintech, TRooTech stands as the best viable choice for financial industries of all sizes and types. The cloud engineering services firm is known for comprehensive consultation and project analysis, custom development and integration services, and continuous ongoing support and maintenance post-implementation.