AML (Anti-Money Laundering) Software Development: A Complete Guide

In this blog, we will discuss in length Anti-Money Laundering (AML) software development that is specifically designed to detect and prevent illegal financial activities, including money laundering and terrorist financing. The blog will serve as a comprehensive guide to CEOs and CTOs of financial companies and institutions, including government agencies, planning to build AML software to identify suspicious transactions, ensure compliance, and mitigate risks, safeguarding organizations from financial crimes.

Let’s face the bitter truth. Money laundering remains a significant challenge and a pressing concern for governments worldwide, impacting developed, developing, and underdeveloped nations alike. Its far-reaching implications threaten economic stability, undermine financial systems, and facilitate illicit activities, making the implementation of robust anti-money laundering measures a global priority.

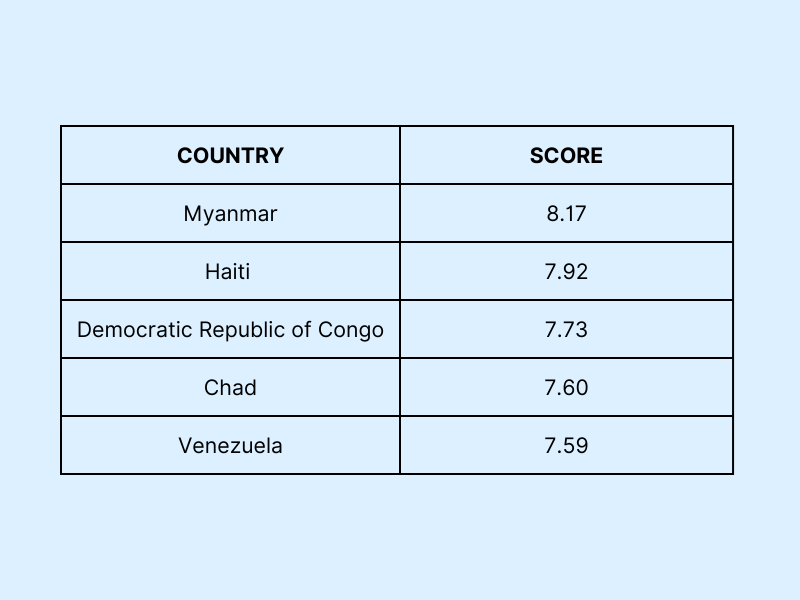

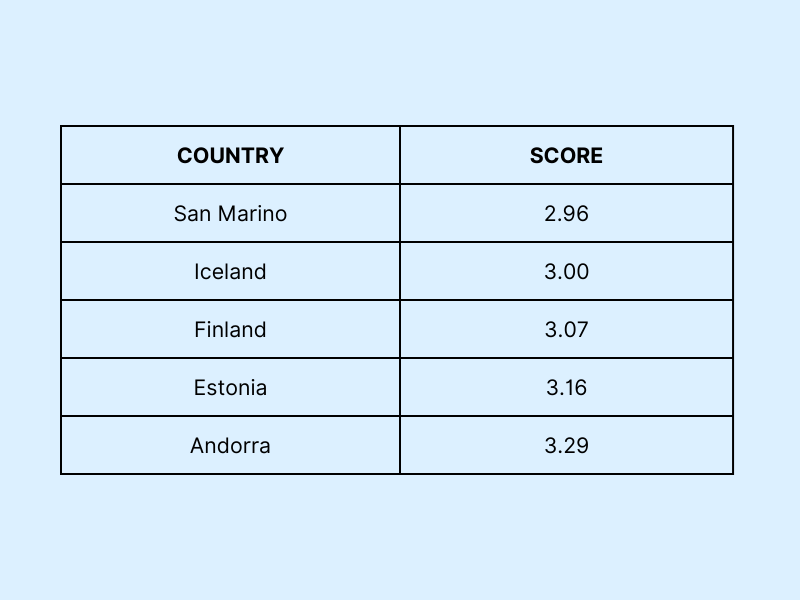

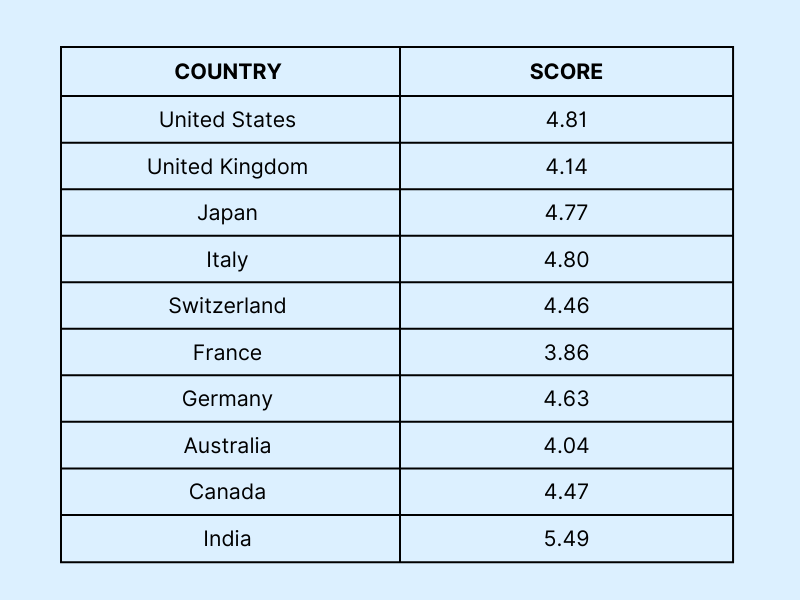

The 2024 Basel AML Index identifies the countries with the highest and lowest risk for money laundering and terrorist financing. Refer to the table below for detailed rankings. Let’s refer to the table below to learn the risk index scores of a few countries.

For your better understanding and analysis, our expert team has created three separate tables depicting the highest and the lowest scores, and scores of the developed countries. We will first start with countries with the highest risk index scores.

COUNTRIES WITH THE HIGHEST RISK INDEX SCORE

Now we are going to list the top five countries with low risk index scores.

COUNTRIES WITH THE LOWEST RISK INDEX SCORE

At last, we have also listed down a few developed countries and their risk index scores.

RISK INDEX SCORES OF DEVELOPED COUNTRIES

Source: BASEL AML INDEX

To substantiate our facts, we can put forth the data of FATF (Financial Action Task Force), the global watchdog that monitors and takes action to combat money laundering, terrorism, human trafficking, and proliferation financing. The inter-governmental body has issued black and grey lists, against jurisdictions with weak measures to curb money laundering. The countries put on black list include North Korea, Iran, and Myanmar.

Significantly, FATF has also put a few Jurisdictions under Increased Monitoring or Grey Lists, The countries included are Algeria, Bulgaria, Croatia, Congo, Haiti, Kenya, Nigeria, South Africa, Venezuela, and more.

Hence, you can observe that most of the countries included in the grey list are those with the highest risk index score.

You must be pondering as to why we discussed the risk index scores, and FATF black, and grey lists data first because this blog is about anti-money laundering software development.

So, the answer to this question is the concept of anti-money laundering and its core guidelines gained global prominence with the establishment of the Financial Action Task Force (FATF) in 1989 and the introduction of an international framework for AML standards.

What is AML?

Anti-Money Laundering (AML) refers to a comprehensive framework of laws, regulations, and procedures aimed at preventing criminals from legitimizing funds obtained through illegal activities. These frameworks disrupt the process of "money laundering," which involves concealing the origins of illicit money to make it appear legally earned.

Financial institutions play a crucial role in maintaining the integrity of the global financial system by adhering to AML standards. Compliance is not only a legal obligation but also vital for protecting their reputation and fostering customer trust.

By investing in robust AML solutions, institutions reduce the risk of regulatory violations and strengthen their overall security posture. Effective AML measures ensure regulatory adherence, protect against financial threats, and support global efforts to curb illicit activities that harm economies and societies.

What is Anti-Money Laundering or AML Software?

Anti-Money Laundering software is a compliance tool used by financial institutions to detect, prevent, and report money laundering activities. It automates processes like transaction monitoring, customer verification, and risk assessment to identify suspicious activities.

AML software screens transactions against global watchlists, ensures compliance with regulations, and generates reports for authorities when necessary. Automating these tasks reduces manual efforts, enhances accuracy, and minimizes risks of regulatory penalties.

Commonly used in banking, insurance, and FinTech, this innovative solution helps organizations protect their systems from financial crime, maintain regulatory compliance, and uphold their reputation in a competitive and regulated market.

The global anti-money laundering software market share is anticipated to touch $9.34 billion by 2034 at a CAGR of 11%, according to Precedence Research.

Before diving into the core aspects of how AML laws and regulations combat money laundering and financial terrorism, let’s first define money laundering and its different techniques.

Money Laundering is the illegal process of concealing the origins of money obtained through criminal activities, making it appear legitimate. It undermines financial systems and enables further crimes, including terrorism and drug trafficking. The process generally involves three stages:

- Placement: Illicit funds are introduced into the financial system, often through methods like bank deposits, cash purchases of assets, or smurfing—breaking large amounts into smaller transactions to avoid detection.

- Layering: This stage obscures the money's origins by transferring it across multiple accounts, jurisdictions, or businesses. Common techniques include wire transfers, cryptocurrency transactions, or investments in offshore entities.

- Integration: The cleaned money re-enters the economy as seemingly legitimate funds, often through business ventures, luxury goods purchases, or real estate investments.

Fortify Your First Line of Defense Against Financial Crime With AML Software

Safeguard Your Business Reputation and Enhance Trust

The Role of AML Systems in Combating Money Laundering

The primary purpose of AML is to combat financial crimes, such as money laundering and terrorism financing, by imposing rigorous standards on financial institutions. These standards include conducting customer due diligence (KYC), monitoring transactions, and promptly reporting suspicious activities to regulatory authorities.

By implementing these measures, AML makes it harder for criminals to exploit financial systems for illicit purposes. It ensures that financial institutions are not inadvertently used as conduits for illegal activities, protecting both the institutions and the broader economy.

Frameworks like the FATF Recommendations establish international standards for detecting and preventing such activities. The USA PATRIOT Act strengthens U.S. laws, emphasizing customer due diligence (CDD), suspicious activity reporting (SAR), and enhanced oversight.

Let’s say for example we came across the official documentation of the FATF Recommendations adopted on February 16, 2012, with regular updates. The recommendations were last amended in November 2023. It contains International Standards for Combating Money Laundering And The Financing of Terrorism & Proliferation.

The recommendations include AML policies and coordination, money laundering and confiscation, important preventive measures, transparency, and beneficial ownership of legal persons. It also underlines the powers and responsibilities of competent authorities and other institutional measures, and lastly international cooperation.

AML Regulations in Different Global Regions

AML Software is vital for maintaining the integrity and stability of global financial systems. Robust AML measures help safeguard financial institutions and national economies against crimes such as corruption, drug trafficking, and terrorism financing. Let’s explore key AML regulations in different global regions. We start with

European Money Laundering Regulations

During our research on the topic, we found that the European Union issues Anti-Money Laundering Directives (AMLD) regularly to standardize AML/CFT regulation across the bloc. All EU member countries have to strictly comply with the regulatory measures set by AMLD in domestic legislation and do so by a predetermined implementation deadline.

The latest EU AMLD measures are the Sixth Anti-Money Laundering Directive (6AMLD) implemented on June 3, 2021, whereas the Fifth Anti-Money Laundering Directive (5AMLD) was incorporated on January 10, 2020.

The United Kingdom AML regulations include the Money Laundering, Terrorist Financing and Transfer of Funds Act 2017, the Proceed Of Crime Act 2002, and the Terrorism Act 2000.

Similarly, Switzerland monitors and regulates illegal money laundering and terror financing under the Federal Act on Combating Money Laundering and Terrorist Financing in the Financial Sector 1997.

Anti-Money Laundering Regulations By the US

In the United States, money laundering and terrorism financing are regulated under the Bank Secrecy Act (BSA) and the Patriot Act. The Bank Secrecy Act was introduced in 1970, requiring banks and financial institutions to implement an internal AML program, while the Patriot Act was enforced in 2001 to combat the response to the 9/11 attacks. The Patriot Act was a modification of the Bank Secrecy Act.

In recent years, the US Congress passed the Anti-Money Laundering Act 2020 (AMLA) in 2021, which is the most significant amendment to the BSA Act. Apart from this, the other vital regulations include the Financial Crimes Enforcement Network (FinCEN); the primary AML/CFT regulator in the US, and the Office of Foreign Assets Control (OFAC), which enforces the US sanctions regulations.

Anti-Money Laundering Regulations Passed By Asian Countries

India - The Parliament of India passed the Prevention of Money Laundering Act (PMLA), 2002, which came into force in 2005 and is one of India’s robust legal frameworks to combat money laundering. The regulation mainly acts against the use of illegal funds, confiscating assets obtained unlawfully, and prosecuting the offenders.

Singapore - Singapore, a FATF member, enforces AML/CFT through the Corruption, Drug Trafficking and Other Serious Crimes (CDSA) and the Payment Services Act (PSA) Acts, regulating money laundering, customer due diligence, and compliance for payment service providers and fintech services.

Hong Kong - Hong Kong aligns with FATF guidance via the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO) and the Banking Ordinance (BO), mandating risk-based AML/CFT measures. The Hong Kong Monetary Authority (HKMA) oversees compliance for banks and financial institutions.

A Few Real-World Examples of Major AML Law Violations

HSBC Money Laundering Case

We came across a BBC report from 2012 where HSBC faced a massive scandal for enabling money laundering activities, including aiding drug cartels and violating sanctions. The U.S. Department of Justice fined the bank $1.9 billion, citing failures in anti-money laundering controls. The report highlighted how the bank's lax oversight allowed illicit funds to flow freely, tarnishing its reputation globally. HSBC pledged to implement strict compliance measures.

However, a decade later in September 2022, the US Federal Reserve terminated the enforcement action after recognizing HSBC's significant strides in improving its practices. This marked a critical milestone in the bank’s journey to restore its credibility and reinforce its commitment to regulatory compliance and ethical operations.

Binance Money Laundering Case

In another major money laundering case, Binance Holdings Limited, the operator of Binance.com, the world’s largest cryptocurrency exchange, pleaded guilty to violating the Bank Secrecy Act (BSA), failing to register as a money transmitting business, and breaching the International Emergency Economic Powers Act (IEEPA). The company agreed to pay over $4 billion in penalties as part of the Justice Department’s investigation.

Founder and CEO Changpeng Zhao, a Canadian national, admitted to failing to implement an effective anti-money laundering (AML) program and resigned. The resolution involved FinCEN, OFAC, and the CFTC.

Why Do Businesses Need AML Software?

Anti-Money Laundering software is essential for businesses to detect, prevent, and report suspicious financial activities. It allows organizations to comply strictly with state and federal laws, jurisdictions, and regulatory standards, minimizes fraud risks, and safeguards the company's reputation.

Businesses can also look to automate complex processes like transaction monitoring and customer due diligence. AML transaction monitoring software empowers companies to operate securely and ethically in today's financial landscape. Let’s list the core benefits of AML solutions below.

Compliance with Regulations

Businesses can choose custom software development services to build tailored AML tools to stay compliant with global financial regulations. These regulations, often complex and continuously evolving, require businesses to implement specific measures to prevent money laundering and terrorist financing.AML software automates the process of monitoring transactions, generating reports, and conducting customer due diligence to ensure adherence to these legal standards.

By maintaining real-time monitoring and ensuring timely submission of required reports, the software significantly reduces the risk of non-compliance, which can result in severe penalties and damage to a company’s reputation. The software is integrated with built-in compliance features to safeguard against regulatory breaches and protect their operations.

We came across a PWC document mentioning non-compliance with laws and regulations in the financial industry and focusing on the International Ethics Standards Board for Accountants (IESBA) issuing pronouncement on professional accountants’ Response to Non-Compliance with Laws and Regulations (NOCLAR).

Fraud Detection and Risk Mitigation

One of the primary benefits of AML solutions is its ability to detect fraudulent activities and mitigate associated risks. The software is integrated with artificial intelligence and uses advanced algorithms to monitor transaction patterns, analyze customer behaviors, and identify real-time suspicious activities. By flagging potentially fraudulent transactions, AML solutions enable financial institutions to act swiftly to prevent losses and protect their assets.

The best AML software provides enhanced risk assessments, allowing businesses to better understand their exposure to illicit activities. Automated alerts, reports, and case management tools further streamline the investigation process, enabling teams to focus on the most critical threats and mitigate financial, legal, and reputational risks efficiently.

A research paper published in ScienceDirect about how anti-money laundering operations monitor various transactions to identify suspicious activities and ongoing transactional analysis. The research paper contains semi-structured interview extracts from different AML experts.

Protecting the Company’s Reputation

A company’s reputation is one of its most valuable assets, and AML software plays an integral role in protecting it. In an era where financial institutions are under intense scrutiny, failure to prevent money laundering can lead to significant public backlash, loss of customer trust, and long-lasting damage to the brand.

By using AML systems to detect suspicious activities and ensure compliance with regulations proactively, businesses can demonstrate their commitment to ethical practices. This fosters trust among stakeholders, customers, and regulatory bodies. A strong reputation for safeguarding against financial crimes not only boosts customer loyalty but also enhances the company’s standing within the industry, ensuring long-term business success.

We came across an article from a reliable and leading statistics company Market.us Scoop informing us that almost all tech and IT giants like Google, Microsoft, IBM, Oracle, Accenture, Intel, SAS, and more develop and use anti money laundering software solutions. Hence, if you are planning to build one, hire software developers from TRooTech to discuss your idea with them.

Key Features of AML Software

Anti-Money Laundering (AML) software has become essential for businesses to detect and prevent illicit financial activities. By leveraging advanced technologies, AML solutions empower organizations to stay compliant with regulations and safeguard their operations. Below are the key features that make AML software effective in detecting financial crime and money laundering activities.

Real-Time Transaction Monitoring

- Proactive Suspicious Activity Detection: AI-enabled real-time monitoring enables organizations to track transactions as they occur, identifying unusual patterns or behaviors that could signal money laundering, such as large cash deposits or frequent transfers to high-risk regions.

- Customizable Rules and Thresholds: AI/ML Development Services allow businesses to configure rules tailored to their risk tolerance, ensuring precise detection of suspicious activities while minimizing false positives.

- Early Risk Mitigation: Immediate alerts empower compliance teams to act swiftly, preventing potential regulatory breaches or financial losses through timely intervention.

Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD)

- Risk-Based Customer Assessment: CDD processes verify customer identities and assess risk levels based on their profiles, ensuring only legitimate clients engage with the business while identifying politically exposed persons (PEPs).

- Deep Dive with EDD: For high-risk clients, EDD digs deeper into financial histories, business activities, and beneficial ownership, reducing exposure to risks such as fraud or sanctions violations.

- Dynamic Risk Scoring: Automated updates to risk scores based on new data help maintain a constantly updated compliance framework, ensuring timely identification of evolving threats.

Automated Reporting and Alerts

- Regulatory Compliance Made Easy: AML software streamlines compliance by generating reports that meet global regulatory standards, such as FATF and OFAC guidelines, eliminating manual effort.

- Timely Notifications: Automated alerts notify compliance teams of unusual transactions or threshold breaches, ensuring that no red flags are missed during daily operations.

- Audit-Ready Documentation: Comprehensive record-keeping simplifies audits and demonstrates due diligence during regulatory checks, protecting the organization against penalties.

Integration With Other Systems

- Seamless Compatibility: Modern AML software integrates effortlessly with enterprise systems like ERP, CRM, and payment gateways, allowing organizations to unify data from various sources for holistic analysis.

- Enhanced Decision-Making: By syncing with other software, AML tools access enriched data sets, improving fraud detection accuracy with better insights and cross-referencing capabilities.

- Scalable and Flexible: Integration capabilities ensure the software evolves alongside the business, adapting to changes in transaction volumes, regulatory requirements, and operational complexities.

Here we can cite the example of a top and leading AML software vendor Nice Actimize which offers a wide range of anti-money laundering solutions suites, such as Onboarding and KYC, Screening, Transaction Monitoring, CDD/EDD, and One Customer Truth- Trusted Entity Risk Profiling.

We also came across the news that Sweden-based TF Bank has chosen Nice Actimize to strengthen its anti-money laundering initiatives and build AML SaaS solutions.

Discover and Harness the Powerful AML Software Features to Prevent Financial Fraud

Make your business future-proof with robust AML software functions

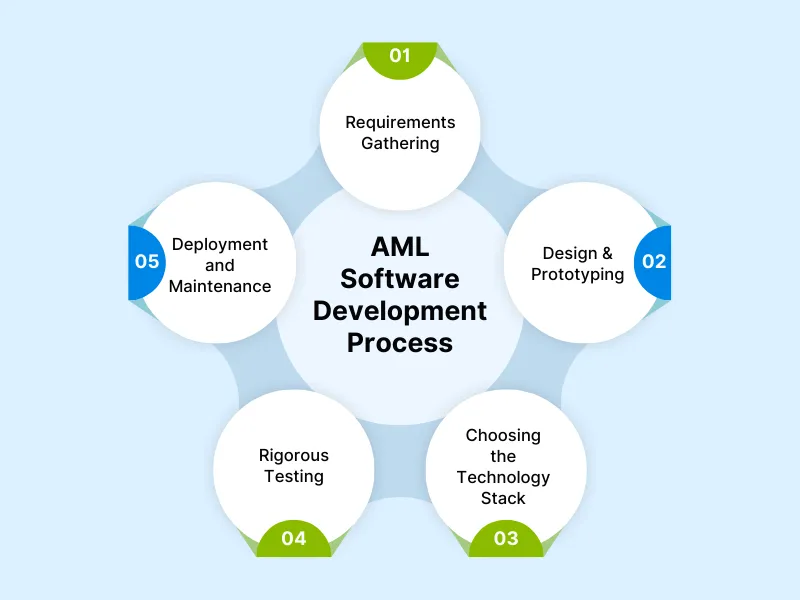

AML Software Development Process

Developing AML solutions requires a methodical approach to meet compliance demands and deliver value to the end users. Leveraging advanced technologies and expert development processes ensures a robust, scalable, and compliant solution for tackling financial crimes effectively.

Requirements Gathering

The development of Anti-Money Laundering (AML) software begins with thorough requirements gathering. This step involves assessing the business needs, understanding regulatory compliance standards, and identifying key functional requirements like transaction monitoring, risk assessment, and suspicious activity reporting. Collaboration with stakeholders ensures the software is aligned with industry mandates and organizational goals. Businesses often hire AI developers at this stage to ensure advanced machine learning models are integrated effectively for pattern detection.

Design & Prototyping

Once the requirements are clear, the design phase focuses on creating a system that is both user-friendly and compliant with stringent regulatory standards. Prototyping helps visualize workflows, interfaces, and reporting mechanisms to gather feedback early. A good AML system design prioritizes seamless integration with existing processes while minimizing false positives. Agile applications play a crucial role in ensuring the infrastructure is ready for iterative updates and scalability.

Choosing the Technology Stack

Selecting the right technology stack is pivotal in AML software development. Languages like Python and Java are popular due to their robustness and flexibility. Incorporating Machine Learning (ML) enables the system to detect unusual transaction patterns, adapt to evolving threats, and improve accuracy over time. Tools and frameworks like TensorFlow and Scikit-learn are commonly used to build ML models, while databases such as PostgreSQL or MongoDB store critical compliance data securely.

Rigorous Testing

Testing is a critical phase to ensure the system’s reliability, security, and performance. Functional testing verifies that each feature works as expected, while security testing ensures the system is robust against cyber threats. Performance testing evaluates how the software handles large volumes of data and concurrent user access. Regular feedback loops between development and testing teams streamline the process, enhancing software quality before deployment.

Deployment and Maintenance

Once tested thoroughly, the software is deployed in a live environment. The focus shifts to ensuring smooth operation, scalability, and ongoing compliance with evolving regulations. Continuous monitoring and maintenance are critical for addressing any emerging issues. Adopting a DevOps for SaaS applications approach ensures rapid updates and system reliability while AI solutions ensure the machine learning models remain effective and adaptable.

A PWC article highlights the importance of choosing the right tools and technologies for building anti-money laundering compliance solutions. The core tools mentioned in the article include Computed Assisted Subject Examination and Investigation Tool (CASEit), Customer Due Diligence Tool (CDD), Name Entity Matching, Suspicious Activity Detection Tuning, and Know Your Customer solutions.

Additionally, we also came across a FATF Publication on Opportunities and Challenges of New Technologies for AML/CFT where the Financial Action Task Force has agreed that new and emerging technologies can enhance the speed, quality, and efficiency of efforts to combat money laundering and terrorist financing.

Benefits of Custom AML Software Development

Custom Anti-Money Laundering (AML) software offers businesses the flexibility and precision needed to address unique compliance challenges. Unlike off-the-shelf solutions, custom AML systems adapt seamlessly to your operations, ensuring efficiency, scalability, and future-proofing. Here’s why building a tailored AML solution is a smart choice for your organization:

Tailored to Specific Business Needs

- A custom AML system is designed to align perfectly with your company’s workflows and requirements.

- Eliminates unnecessary features found in generic software, reducing complexity.

- Allows integration with existing systems like ERP, CRM, or financial platforms for smooth data flow.

Scalable as Business Needs Evolve

- Custom solutions can grow with your business, adapting to new markets, clients, and regulatory demands.

- Flexibility to add new modules, features, or analytics capabilities as required.

- Ideal for businesses in fast-changing industries where scalability is critical.

Cost-Effective in the Long Run

- While the initial investment may be higher, custom AML software reduces long-term costs by eliminating licensing fees.

- Streamlines compliance processes, saving time and resources on manual efforts.

- Minimizes risks of fines or penalties through enhanced accuracy and compliance adherence.

Future-Proofing with New Technologies

- For better fraud detection, custom solutions can incorporate emerging technologies like artificial intelligence statistics and facts, blockchain, and machine learning.

- Ensures your AML system remains compliant with evolving regulatory standards.

- Offers the ability to quickly integrate new tools or updates without depending on third-party providers.

So, how is custom anti-money laundering software different from off-the-shelf AML solutions? Let’s find out.

Firstly, custom AML software is tailored tools designed to meet unique business requirements. You may find the initial upfront costs higher but in the long-term scenario, it often proves to be a cost-effective option minimizing the need for frequent modifications. Its high customization ensures optimal performance and adaptability to evolving regulations.

On the other hand, an off-the-shelf AML system is more affordable initially and faster to deploy but may incur higher costs over time due to limited scalability and frequent updates. It offers generic features, which may not fully meet specific business needs, potentially affecting performance.

We also came across several customer testimonials on different platforms, such as Gartner, Clutch, and G2. They have reviewed various AML development companies, such as SAS, Dow Jones, Nice Actimize, and more, helping them create custom AML solutions.

Unlock and Enhance the Full Potential of Custom AML Software Solutions

Stay ahead of financial risks with our tailored AML software

How Can TRooTech Help With Anti-Money Laundering Software Development?

TRooTech Business Solutions is a premier and leading custom software development company having profound expertise in building agile and innovative software solutions, tailored to meet every unique business need with efficiency and precision.

With more than a decade of hands-on experience and a versatile and skilled team of 100+ software developers, we can help organizations of all sizes create AML software that takes businesses ahead of the curve. TRooTech delivers innovative, scalable, and secure solutions tailored to address the complexities of regulatory requirements.

Every business operates within a unique ecosystem, and we ensure that AML software aligns perfectly with your operations. By leveraging cutting-edge technologies, including AI and machine learning, we craft tools that detect suspicious activities, generate comprehensive reports, and streamline compliance workflows. Whether integrating with existing systems or building from the ground up, our solutions offer flexibility without compromising performance.

With a proven track record in financial software development, we at TRooTech understand the stringent demands of regulatory compliance. From Know Your Customer (KYC) processes to real-time transaction monitoring, the company’s solutions incorporate features that meet global standards, including FATF, AMLD, and OFAC regulations.

We have worked with diverse clientele, including leading Fintech companies and financial institutions to develop customized solutions.

Built a Digital Financial Management System to Enhance Workflow and Efficiency

For instance, we can highlight one of our successful projects where we created a tailored financial management system for a popular Fintech company that provided real-time insights on financial conditions and financial performance ratings. Our seasoned software engineers and developers built a cloud-based rating report system with risk assessment features, complying with industry standards and popular regulations.

Our solutions empower banks, governments, and corporations to drive growth and enhance efficiency while effectively mitigating rising costs and risks.

Conclusion

AML software is essential for businesses to combat financial crimes, ensure regulatory compliance, and maintain trust. It helps identify, monitor, and report suspicious activities, safeguarding organizations from legal and financial risks.

Today, businesses are looking to develop custom-built AML solutions that add significant value by aligning with specific needs, streamlining compliance processes, enhancing aud detection, and reducing operational inefficiencies while adhering to global standards.

Anti-money laundering software is integrated with transformative technologies like artificial intelligence, machine learning, and blockchain to ensure real-time monitoring of financial activities, providing businesses with a robust defense against financial crimes.

We can cite the quotation from Joe Robinson, Co-Founder and CEO of Hummingbird.co, highlighting the importance of AI in financial regulations - “ The good news is that financial regulators globally have, in recent years, embraced AI-driven innovation as an appropriate if not necessary development in addressing financial crime.”

Additionally, our research team also found a report published by Capgemini as the point of view that says that AI is the only way to address sanctions and adverse media screening. The report further urges financial institutions to implement best industry practices and regulatory expectations.

Hence, this is the right time to develop a custom AML software tool for your organization and safeguard all financial activities and transactions from modern and evolving perils of fraud. At TRooTech, we specialize in developing tailored AML software. By leveraging advanced technologies, we deliver secure, scalable solutions that empower businesses to mitigate risks and maintain compliance effectively.

Also, we have curated a detailed guide on AI development costs, which will help you plan your budget for integrating AI/ML technology into the AML system and make informed decisions.

Discuss your project idea with our expert consultants to build innovative solutions that align with your business goals and drive success.

FAQs

Anti-Money Laundering (AML) software is a tool used by financial institutions to detect, prevent, and report suspicious financial activities related to money laundering and terrorist financing. It helps organizations comply with regulatory requirements and minimize financial crime risks by monitoring transactions and ensuring adherence to local and international laws.

Core features of AML software include transaction monitoring, customer due diligence (CDD), risk assessment, suspicious activity reporting (SAR), and compliance reporting. It leverages data analytics and machine learning to detect unusual patterns, enabling institutions to identify and act on potential financial crimes efficiently, ensuring compliance with regulations.

Custom AML solutions offer tailored features to meet specific regulatory requirements, improving compliance and operational efficiency. They enhance fraud detection, reduce false positives, and provide seamless integration with existing systems. Customization allows for scalability, adaptability, and improved risk management, providing businesses with more precise control over AML processes.

TRooTech specializes in developing secure, scalable, and customizable AML software solutions. Our team ensures seamless integration with existing systems and compliance with global regulations. We focus on delivering innovative, user-friendly software that streamlines AML processes, reduces risks, and enhances data security, ensuring clients stay ahead of financial crime challenges.

The cost of developing AML software varies significantly based on factors such as the complexity of the features, the scale of the system, integration with existing infrastructure, and compliance requirements. At TRooTech, we offer customized quotations tailored to your specific business needs, ensuring a cost-effective solution that aligns with your objectives and regulatory standards.

AML software integrates advanced technologies like machine learning, artificial intelligence (AI), big data analytics, and blockchain. These technologies enhance fraud detection accuracy, improve predictive analytics, and ensure secure, transparent transactions. AI and machine learning help refine risk models, while blockchain ensures data integrity, preventing manipulation and enhancing trust.